COVID-19’s Effect on the Global Music Business, Part 1: Genre

Chartmetric's data-driven analysis of COVID-19’s effects on music-related consumption helps artists, songwriters, labels, agencies, distributors, and other entertainment-related entities sustain and improve their well-being during these unprecedented times. 23 APR 2020

To help address the global music industry’s concerns about the COVID-19 pandemic, US-based music analytics company Chartmetric is continuously monitoring 2M+ artists across 20+ streaming and social media data sources.

We hope our data-driven analysis of COVID-19’s effects on music-related consumption helps artists, songwriters, labels, agencies, distributors, and other entertainment-related entities sustain and improve their well-being during these unprecedented times.

All data is collected, organized, and analyzed by Chartmetric. Data science by Nuttiiya Seekhao. Analysis by Jason Joven, Rutger Ansley Rosenborg, and Michelle Yuen.

Key Takeaways

Spotify listenership appears to be widening for Classical, Ambient, and Children’s due to COVID-19.

Spotify listenership is relatively unaffected for Pop, Country and Dance during COVID-19, but Country seems to be demonstrating the greatest resiliency.

Spotify listenership appears to be narrowing for Latin, Rap, and Rock during COVID-19, but potentially due to other factors and not necessarily a result of the global pandemic.

The COVID-19 Context

If you’ve been a part of the global music industry, you have been well aware of the damage COVID-19 has done to music from multiple industry angles. While streaming has been relatively untouched from a revenue standpoint, its most popular artists’ music has tended to receive less play. On the other side of the spectrum, the live music sector has taken the brunt of the industry trauma, with public companies like Live Nation taking huge stock price hits, and other larger-than-life firms like talent agency Paradigm suffering layoffs. New shows and movies can’t shoot and public venues playing music can’t open, so licensing has taken a hit as well, and because music studios don’t likely qualify as essential businesses, their futures are uncertain.

The worst hit are our everyday artists, but workers who make the live scene possible fare no better. Music, in its highest form, is about community, as many of COVID-19’s unexpected moments have shown us: a Spanish fitness instructor leading a class from his rooftop, apartment building sing-alongs, and our beloved medical workers taking a well-earned moment of levity.

iMarkkeyz' "Cardi B Coronavirus Remix Video" (2.3M YouTube views) first blew up on the DJ's Instagram(March 13) and then made it to Cardi B's own profile (March 16)

Previous industry news has already shown us the broader, market-level strokes: Video-streaming platforms like Netflix and YouTube are getting more play while most of the world shelters in place. The assumption is that streaming music nowadays tends to be an activity that co-exists with others: commuting on the train, driving in the car, working out, socializing with others. With our public transportation abandoned, reasons for going out limited, gyms closed, and citizens in quarantine, it’s no wonder people’s attention gets shifted toward mediums that tend to require multisensory engagement.

COVID-19 and Genre: Considerations

If we want to develop a nuanced understanding of music consumption in the COVID-19 era, we have to lead with a manageable perspective. Here, we start with streaming insights at the genre-level.

Baked into music genres is an assumption of listener populations that share some sort of geography, culture, and entertainment consumption habits. By examining Spotify Monthly Listeners as measurements for these factors during the pandemic’s spread, we can attempt to put metrics to these dimensions.

First, a timeline: We determined March 3, 2020, to April 9, 2020, as our window for this genre-level look. To extend back to Jan. 1 or earlier would be valid, but we would also risk losing some of the trends that become more visible during a shorter period of time. Too late, and we may cut short trends already in progress.

A worldwide Google Trends “Coronavirus” search peaked on March 15, 2020, suggesting an apex of global curiosity and effects of government-enforced (or fear-induced) lockdown.

Though internet searching is one of many ways to measure public sentiment, a Google Trends search on “Coronavirus” is a simple (if imperfect) way to summarize how much news and Internet-driven concern there is about a topic. You can see that at the global level over the past three months, initial curiosity peaked on March 15 (the graph does not have a “unit,” as it is normalized from 0 to 100). While there were small waves of interest in mid-January and mid-February, the real surge occurred in early to mid-March when governments at international, national, and local levels began enforcing shelter-in-place or self-quarantine measures to help “flatten the curve” of rising virus infections among the public.

Given the fact that we are searching for the effect on genres from a streaming perspective, it makes sense for us to observe any possible activity changes focused on this time period in particular. When lifestyle changes, it’s reasonable to expect an effect in many parts of life.

A New York Times graph showing the different levels of coronavirus deaths at the country-level.

Geographically speaking, with respect to COVID-19’s effect on society, it’s important to note that different regions of the world have had vastly different responses and histories to epidemics threatening their citizens. At the time of writing, South Korea and Taiwan are a couple of the nations who have been lauded for their expedient and successful handling of the crisis, while other countries like Brazil have only now begun to implement public restrictions.

With respect to Spotify’s user base, consider whose app usage we are measuring. Note below Spotify’s Q4 2019 Monthly Active User (MAU) base, or the number of users who have used Spotify in the past month, broken down by international region.

Spotify’s Q4 2019 Monthly Active User (MAU) base favoring Europe and North America at a 62 percent combined total.

So, the varying behavior measured in this time period will contain more than 60 percent of a North American/European bias. Latin America is at 22 percent (though it’s unclear if Mexico, containing one of Spotify’s biggestmarkets, is included in North America or here), while huge swaths of populations in Africa, Asia, the Middle East, and Oceania all get binned into the 16 percent “Rest of World” category. We should note that any Spotify analysis is going to strongly minimize most of these markets’ tastes and preferences.

While Spotify is global, it’s worth mentioning that the platform is still limited to its market reach. Knowing these limitations, we can resume our interpretation of the genre-based insights we uncovered.

Our ‘Trendy’ Approach

Spotify Monthly Listeners (MLs), as used here, is a Spotify-generated statistic showing the cumulative number of unique listeners for an artist in the past 28 days. It is about how “wide” a listenership is (while stream count can be considered how “deep” an audience listens). Its “reach” nature is largely fueled by a combination of new releases and editorial playlisting. For this analysis, we collected MLs data for the Top 100 artists of each genre, ranked by Spotify Follower count.

Genres are social constructs and inherently subjective, so we’ve attempted to optimize our categorizations to traditional industry expectations. Here are some sample sub-genres from each of the nine genres we looked at:

1) Classical, Ensemble & Opera includes romantic era, early modern classical, a cappella

2) Ambient, Relaxation & Experimental includes compositional ambient, lo-fi beats, new age

3) Hip-Hop & Rap includes trap music, gangster rap, underground rap

4) Pop includes dance pop, post-teen pop, pop rap

5) Country includes contemporary country, country road, nashville sound

6) Dance & Electronic includes edm, tropical house, funk carioca

7) Latin & Caribbean includes reggaeton, latin trap, latin pop

8) Rock, Punk & Metal includes modern rock, protopunk, alternative metal

9) Children’s includes children’s music, musica para niños, kindermusik

“Normalized” measurements mean that we mathematically translated those absolute numbers to a uniform scale in order to zoom in on subtle dynamics and trends. For example, the chart on the bottom left is absolute, and the chart on the bottom right is normalized, but it’s the same data!

Spotify Monthly Listeners for Classical music (March 3-April 9, 2020). The left graph is raw data, and the right graph is normalized to show the subtle trends. Don't get intimidated: it's the same data!

The Top 100 Classical artists according to Spotify Followers that make up the above two graphs. This is how we'll examine each of the nine genres below.

Here is a link to all the charts with the Top 100 artists in each genre. We will truncate the artist name charts below to focus on the genre trends.

Classical and Ambient: The Big Quarantine Winners

According to a number of different sources, Classical, Ensemble & Opera ( “Classical”) and Ambient, Relaxation & Experimental (“Ambient”) music seems to have really won out in these dark times. Working from home has become the new norm for many, and apparently, lyrics just get in the way — either that, or listeners are seeking a sense of calm and order when work, school, social, and family routines have been turned upside down.

Both genres have helped determine an important marker for when Spotify users started to exhibit unique behavior, relative to other genres. This inflection point occurs roughly around March 18th, and near where the “coronavirus” Google Trend peaks, as noted above.

A look at the Spotify Monthly Listeners trends for the Top 100 Ambient artists suggests a genre-wide lift during COVID-19 lockdown for many European and North American countries.

In Ambient’s Top 100 artists, you can see a grouping of high-flying artists around the 0.9-1.0 range, and then a band of artists between the 0.6-0.8 marks. There is even a loose category of artists who trend down strongly from the beginning of March, losing MLs quickly.

But the interesting inflection point is between March 16 and March 23, where all three groupings trend high and to the right, peaking at the April 9 end of the timeline. Approximately 80 percent of the artists here do so. So, no matter what their MLs momentum was, they seemed to march to the beat of the same drum at the same time.

A look at the Spotify Monthly Listeners for the Top 100 Classical artists suggests a genre-wide lift during COVID-19 lockdown for many European and North American countries.

With Classical, an even stronger lift trend reveals itself around March 18. Here, one grouping of artists have decent MLs, while a heavy clustering of artists have minimal MLs starting from the beginning of March. Yet again, we see another coinciding trend up in mid-March in both bands, also terminating on April 9 at their highest level within the time period. Even some of the “noise” that does not fall into either of the groupings trends up slightly in mid-March, with only 10-15 percent of the artists showing no coinciding behavior.

We’ll say it a million times: correlation is not causation. It’s a basic tenet in statistics and data science. But it’s certainly a notable coincidence. And in case you’re wondering, “Well, maybe this is what always happens this time of year”.... We wondered the same.

Averaged Spotify Monthly Listeners for the Top 100 Ambient artists in March 2019 (dotted) vs. March 2020 (solid) showing that the 2020 bump does not seem to be cyclical/seasonal.

What you see above is the averaging of the Top 100 Ambient artists, also by normalized Spotify MLs, for the March 1, 2020, to April 9, 2020, time period. The dotted blue line is the same time of year, but in 2019. As you can see, there is a world of difference. In 2019, Ambient more or less was coasting along with little variation, while 2020 revealed a 2.3x MLs jump between around March 11 and April 6.

Averaged Spotify Monthly Listeners for the Top 100 Classical artists in March 2019 (dotted) vs. March 2020 (solid) showing that the 2020 bump does not seem to be cyclical/seasonal.

For Classical, we see a similar trend: 2019’s ML count showing a holding pattern and 2020 showing a 5x increase in MLs between March 15 and April 6.

So, while both of these genres seem to have correlating Spotify MLs patterns synced to the same timeline, what makes the COVID-19 correlation an even more convincing argument is what Rolling Stone’s Samantha Hissong alludes to in her April 7, 2020, article: “Spotify has noticed more ‘chill’ music on users’ playlists in general, as people add songs that are noticeably more acoustic, less danceable, and have lower energy than songs they’ve added in the past, the company said.” Hissong concludes the behavior is platform-independent, citing similar patterns at Deezer and Pandora.

This bolsters the argument that we may be seeing a pandemic-induced lifestyle change. But let’s continue with our examination of other genres.

Pop and Rap: Music Business as Usual

One would think that the ubiquity of Pop and Hip-Hop & Rap (or “Rap” for this article), especially in the North American and European regions, might shield them most from any kind of negative impact on the streaming industry in general. Indeed, it turns out that both genres seem unfazed by social distancing.

Spotify Monthly Listeners for the Top 100 Pop artists suggests “business as usual” and no discernible COVID-19 effects.

Keep in mind that these are the Top 100 artists in each genre, according to Spotify Follower count. The idea is that Followers signify more of the “old guard” of each genre: the long-standing representatives having the most sway within their respective sectors.

Contrast this with artists who have the most Monthly Listeners, a stat that tends to accentuate artists who just came on-cycle after a heavily-marketed new release, ranked high on several editorial playlists, and likely just came off of a hot rise on TikTok. It’s not that the Lil Nas X’s and Tones and I’s of tomorrow can’t eventually have the most Followers…. It just takes more time.

Having said that, note that Pop’s chart here shows a more varied pattern than Classical or Ambient’s. You can still see a grouping of Pop artists who aggregate down and to the right, each trending down at various parts of the five-week period. Roughly half of the Top 100 fall into this trend.

But the other half form a peppering of artists that seem to exhibit the ever-on nature of Pop music, and likely the dispersed effect of weekly placements on Today’s Top Hits or Songs to Sing in the Car. Notice many of the drastic MLs changes after the Fridays of each week (more noticeable near March 13 and March 27), when Global Release Friday and the subsequent refreshing (track adds and removals) of many editorial playlists happens.

Spotify Monthly Listeners for the Top 100 Rap artists suggests “business as usual” and no discernible COVID-19 effects.

Rap doesn’t seem to look any different: Nearly half of the artists trend up or down strongly, likely from a placement/removal on RapCaviar, Most Necessary, etc. The other half trends down gradually from March to April, presumably off-cycle.

What’s most important with regard to COVID-19: There seems to be no conclusive correlation near the mid-March point, where we see the more decisive changes at the collective genre level. Pop and Rap simply seem to be business as usual with some artists going up and some going down at various points in time.

Averaged Spotify Monthly Listeners for the Top 100 Pop artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s decline is cyclical/seasonal and not necessarily COVID-19-related.

When looking at Pop’s 2019 vs. 2020 comparison, there doesn’t seem to be any unique reflections in mid-March or between years — just a rather insignificant trend down (just 1.2x) during the period. However unsexy, noting “no change” is still an insight.

Averaged Spotify Monthly Listeners for the Top 100 Rap artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s decline is not cyclical/seasonal.

As for Rap, there seems to be an interesting opposing trend between 2019 and 2020. It’s even tempting to say COVID-19 is the cause of it, but that would be premature.

On one hand, if Spotify listeners, primarily based in North America and Europe, didn’t really start changing their daily lives until mid-March, why would Rap be affected beforehand?

Italy, which became Europe’s epicenter for a period of time, didn’t experience a national lockdown until March 9. The United Kingdom didn’t do so until much later on March 23, and Spotify surpassed the BBC in listenership long ago in 2017.

On the other hand, consider that for many American college students (and an engine for Spotify’s 217M+ MAUs in Q1 2019), March Spring Break plans were likely cancelled, despite what many articles alluded to. While there were certainly outlying individuals that generated scorn from many, it wouldn’t be a stretch to say that the more prudent exchanged their week of social partying for solo Netflix-binging throughout the month of March. That said, it is possible that Rap — a genre known along with Dance as being quite popular in such scenarios — began a drawdown at the beginning of the period.

Another argument is people working from home (and contributing to the Ambient and Classical genres) might find Pop and Rap a little too distracting for writing emails. The bottom line for both Pop and Rap? It’s hard to conclude COVID-19 had a significant correlation with either genre.

Country and Dance: Two Steps in Either Direction

Country and Dance & Electronic (or “Dance” for this article) are certainly two genres that could hardly be more different. The former resonates in the Southern states of the U.S. and frequently references rustic lifestyles, patriotism, and wholesome values. The latter is known for its globalism, in part due to its frequently upbeat, lyricless nature, and in part due to many nations playing host to thriving club scenes.

But during COVID-19’s initial epidemic stage in March 2020, neither genre featured a significant mid-March “bump” in Spotify MLs.

Spotify Monthly Listeners for the Top 100 Country artists suggest a widening in listenership, but not necessarily due to COVID-19 effects.

Looking at Country’s Top 100 artists, it’s been a relatively positive month. The grouping of about 70 percent of the artists on an upward trend by April 9 means that most of Country’s most followed artists are gathering broader audiences on Spotify.

Looking at Fridays within this time period, you can see several of the artists experiencing severe upturns and downturns, likely due to the volatility of the platform’s biggest Country playlists like Hot Country (5.7M Followers) and Chillin’ on a Dirt Road (2.2M). This is similar genre behavior to what we saw in Pop, except a bigger portion of Country’s artists are trending up in MLs. For reasons unknown, even though the overall number of streams declined during the lockdown period, Country steadily widened its listener base.

Spotify Monthly Listenership for the Top 100 Dance artists suggests no genre-level trend and no discernible COVID-19 effects.

For Dance, it appears similar to Rap’s profile: Some of the Top 100 artists gently narrowing in MLs, with the others are neutrally coasting along or experiencing a broadening in MLs. While the graph does exhibit some Friday-centric trend changes, it seems more of a muddled composition, which suggests that Dance is not nearly as editorially playlist-driven when it comes to broadening listenership.

Either way, neither Country or Dance shows any conclusive COVID-19-related behavior.

Averaged Spotify Monthly Listeners for the Top 100 Country artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s increase is cyclical/seasonal.

Turning to their 2019 Monthly Listenership, we see further evidence that pandemic-related effects are not an issue for the Country genre thus far. This year’s average nearly mirrors the same widening pattern week for week, doubling its size in Monthly Listeners.

Averaged Spotify Monthly Listeners for the Top 100 Dance artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s gradual decline is cyclical/seasonal.

While more erratic, this year’s MLs count for Dance & Electronic also follows the previous year’s downward trend. We should note that this is a very subtle trend, as our vertical axis of Spotify MLs is shrunk down between .30 and .36. So, while there’s an interesting slight broadening of listenership during the early work week, and dumping during the weekends, compared to some of the other genres we examined, it’s negligible.

Latin and Rock: Rolling With the Punches

Because COVID-19 reached much of Latin America much later than it did Europe and the U.S., significant measures to stem the spread of the infection weren’t taken by some major Latin American governments until weeks later, shifting the timeline for the region in the process. Mexican President Andrés Manuel López Obrador, for example, didn’t start urging people to stay home and social distance until the end of March. Brazil’s Jair Bolsonaro, meanwhile, still has yet to do so.

Yet, according to a recent Nielsen report, the Latin genre experienced the highest decline (14.1 percent) in cross-platform audio streaming for the week ending on March 26. Interestingly, it was the only genre that also experienced a decline (7.6 percent) in cross-platform music video streams.

With many Latin American markets, from Mexico City to Santiago, Chile, driving global streaming consumption on Spotify and YouTube — and likely accounting for a significant portion of Latin & Caribbean artists’ MLs — that data comes as a bit of a surprise.

If daily Latin American life was essentially pre-lockdown during this period, how can we frame the unexplained downturn in cross-platform streams?

Spotify Monthly Listeners for the Top 100 Latin artists shows a genre-level trend downwards, though not necessarily due to COVID-19 effects.

Focusing on our Spotify-only analysis, roughly 75 percent of the top Latin & Caribbean artists are experiencing a narrowing trend in their monthly listenership, with the rest of the artists on various patterns. But it’s here where we have to remain vigilant from confusing COVID-19 correlations with unrelated listenership movements.

While 10-20 percent of the artists seem to exhibit a sharper downturn in mid-March (and when Spotify’s European/North American user base suffered COVID-19 effects), most of the down trend was already underway at the beginning of March, when Latin America hadn’t really taken corrective measures yet. Which begs the question: is Latin losing North American/European listeners (given Spotify’s user base)? We’d have to reference last year’s listenership later to better understand.

When it comes to Rock, a similar “false positive” behavior appears: one that suggests a coronavirus correlation, but may be benign. Nielsen’s cross-platform data puts the genre in the middle of the pack in terms of audio streaming decline (9.7 percent), and a modest lift in music video streaming (10.7 percent).

Spotify Monthly Listeners for the Top 100 Rock artists shows no genre-level trend and no observable COVID-19 effects.

Looking at the Spotify-only trends of the Top 100 Rock, Punk & Metal artists, there is some overall decline, but not as tightly grouped as we saw with Latin & Caribbean. In fact, a good portion of Rock, Punk & Metal artists seem to be on the incline since mid-March. Since the activity here is more erratic (especially on March 13 and 20), we observe no genre-wide COVID-19 correlation for Rock.

Averaged Spotify Monthly Listeners for the Top 100 Latin artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s decline is not cyclical/seasonal.

The much different and neutral flatline of Latin & Caribbean’s 2019’s listenership suggests a pandemic-related narrowing for Latin in 2020, but it requires more research. The March 2020 downturn seems to correlate to what most of European and North American listeners were experiencing in their day to day life, though it was a subtle shift down (x1.4). It’s possible that ex-LatAm territories simply just explored the genre less, seeing some of its biggest artists (e.g., Daddy Yankee, J Balvin) as mostly party-oriented fare.

To be fair, global consumption of the genre could just be down this quarter, irrespective of any COVID-19 effects. As Music Business Worldwide points out, Latin music’s share of the American market was indicating signs of decline in 2019.

Averaged Spotify Monthly Listeners for the Top 100 Rock artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s decline is not cyclical/seasonal.

Rock, Punk & Metal in 2019 exhibited a widening trend, while it showed a similar decrease as Latin did in 2020.

This could suggest that something has changed in the MLs patterns between March 2019 and March 2020, but again, both of these genre groupings might just be in decline this quarter irrespective of COVID-19.

Children’s: Growing Up in Turbulent Times

There is no shortage of articles recommending best practices for working from home with kids, and for many parents who have suddenly found themselves juggling two full-time jobs, the importance of digital media for alleviating some of the burden, for better or worse, has become more pronounced.

According to an Axios article sourcing data from “kidtech startup” SuperAwesome, “Traffic to kids apps and digital services has increased by nearly 70 percent in the U.S.,” and “most children ages 6-12 say they are spending at least 50 percent more time in front of screens daily.”

The natural conclusion to draw is that Children’s content across various digital media platforms should follow suit and explode. Given the fact that tablet usage is trouncing phone, television, and desktop computer usage, the bias should logically skew toward visual-based media and across platforms like Netflix and YouTube. However, for parents wanting to reduce screen time for their children while increasing the amount of time they’re able to focus on their work, audio-based media should, theoretically, come in handy as well.

Looking at the Spotify MLs data for the 100 most followed Spotify profiles in the Children’s genre, there does appear to be a general trend upward, with a concentration at the upper end of the range in late March and early April 2020.

Spotify Monthly Listeners for the Top 100 Children’s artists showing a genre-level widening in listenership that is more spread out over March and is suggestive of COVID-19 effects.

However, there are some key differences between the way Children’s was trending in March and some of the other genres we’ve looked at. As opposed to a pronounced mid-March acceleration, MLs here seem to follow more linear trajectories that come to a point in early April.

Important to factor in here is how global this Top 100 is, with some of the most followed artists being from the US, but also Spanish-speaking countries and Germany. Because it’s less solely biased toward the US market than some of the other genres, it’s less likely to track with the timeline of the US COVID-19 curve and more likely to reflect multiple regional timelines from around the world.

In other words, the cumulative Children’s genre-level increase appears to morph into a more spread-yet still dramatic-widening of listenership.

Averaged Spotify Monthly Listeners for the Top 100 Children’s artists in March 2019 (dotted) vs. March 2020 (solid) suggests that 2020’s decline is possibly cyclical/seasonal and potentially exacerbated by COVID-19 effects.

COVID-19 is one of the likeliest factors for Children’s music, based on everything we know about the uptick in consumption for Children’s content.

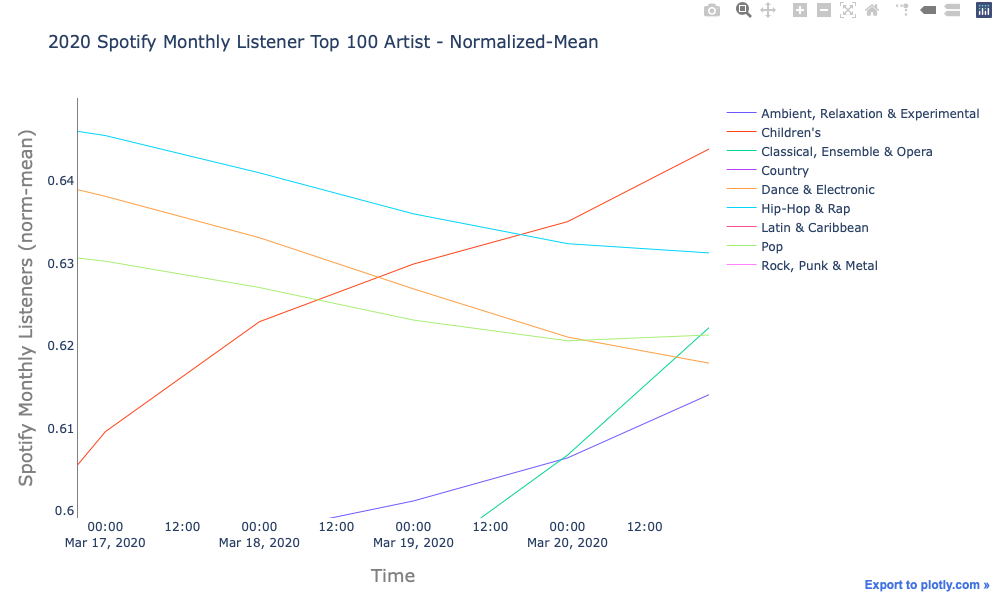

The Spread: COVID-19 Across All Genres

What we have yet to do is zoom out to provide a more holistic view of the genre landscape in order to help you understand exactly how the average MLs dynamics of each genre’s Top 100 artists stack up against each other in the Spotify marketplace.

Below, are the averaged Spotify MLs for the Top 100 artists of each of the nine genres we discussed above to better understand their relative movements in March 2019.

Below, are the averaged Spotify MLs for the Top 100 artists of each of the nine genres we discussed above to see how they've changed this year.

Ultimately, the question of how dramatically COVID-19 has changed consumption behavior in the music industry is extremely complicated and might not be revealed in full for many more months — or even years. That said, within the complexity of proxy variables, normalizations, and abstract graphs, there are some important stories to tell — from the rise of content that gives us peace of mind in a time of unprecedented anxiety to the apparent stolidity of more regional-based genres in the face of global crisis.

Amongst changing industry dynamics and fundamental social interactions, there’s no shortage of conjecture, but one thing is clear for us: The future remains uncertain for everyone, so we’ll do our best to use the power of data and market-level analysis to bring continued clarity and nuance to the conversation.

Stay tuned for our analysis of YouTube consumption by country in Part 2. You can subscribe to have it delivered to your inbox when we publish.

View the original post here.